ADVANCE TAX ON PURCHASE / SALE / TRANSFER OF IMMOVABLE PROPERTY

The rate of advance tax to be collected from buyer or seller on purchase/sale/transfer of property has also been increased from 2% to 3% for those appearing on ATL (filer).

As a result, the rate of tax on those not appearing on the ATL (Non-Filer)will also be

increased as under:

(i) On purchase of property – from 7% to 10.5%

(ii) On the sale of property – from 4% to 6%

TAX CREDIT FOR CONSTRUCTION OF NEW HOUSE

A new tax credit is introduced for an individual with regard to the construction of a new residential house, subject to the following conditions:

a) Available for the tax year 2024 through the tax year 2026;

b) The said house is completed during the said tax year and the completion certificate is furnished along with the return;

c) The amount of tax credit shall be lesser of:

(i) 10% of tax assessed to the person for the tax year; or

(ii) one million rupees; and

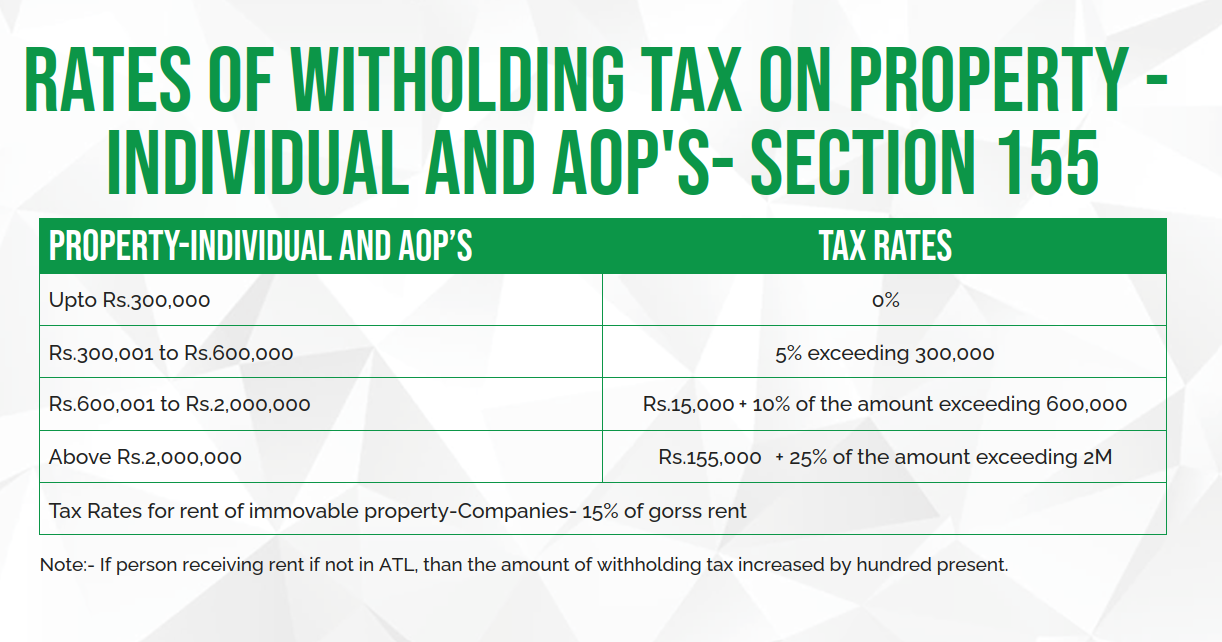

Rates of tax on rent from property

Individual and AOP’s- Section 155

Property-Individual And AOP’S TAX RATES

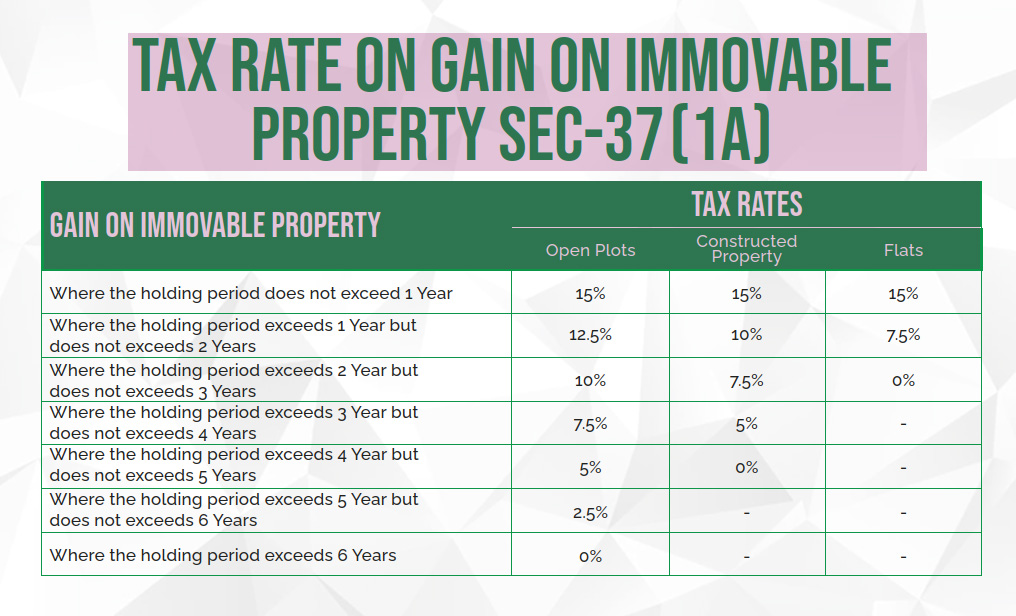

Tax rate on gain on immovable Property Section 37 (1A)

TAX ON DEEMED INCOME UNDER SECTION 7E

Through the Finance Act, 2022, a resident individual owning immovable properties in Pakistan is subjected to tax on deemed income from such properties for tax year 2022 and onwards. Such deemed income is effectively taxed at 1% of the FBR values of immovable properties. The said tax is not applicable on certain immovable properties which inter alia include the following:

a) one immovable property owned by the resident person;

b) any property from which income is chargeable to tax under the Ordinance and tax leviable is paid thereon;

c) immovable property in the first tax year of acquisition where tax under section 236K has been paid;

d) where the fair market value of the properties in aggregate excluding certain specified properties does not exceed Rupees twenty-five million

ADVANCE TAX ON THE PURCHASE OF IMMOVABLE PROPERTY BY OVERSEAS PAKISTANIS.

It is now proposed that advance tax would not apply if the buyer or transferee is a non-resident individual holding a Pakistan Origin Card (POC) or National Identify Card for Overseas Pakistanis (NICOP) or Computerized National ID Card (CNIC) who has acquired the said immovable property through a Foreign Currency Value Account (FCVA) or NRP Rupee Value Account (NRVA) maintained with authorized banks in Pakistan under the foreign exchange regulations issued by the State Bank of Pakistan upon submission of the certificate as may be prescribed.

TAX EXEMPTION EXTENDED FOR SALE OF IMMOVABLE PROPERTY TO REIT

The period of exemption on profits and gains on the sale of immovable property or shares of Special Purpose Vehicle to any REIT scheme was due to expire on June 30, 2023. The same is now proposed to be extended to June 30, 2024.

Views: 67