Introduction

In this case study, tabulated below are 4 real-life examples of “investment advices” picked up from this (investors of Pakistan) group as sample for this real-life case study. It may kindly be noted, much has been left to be calculated from so many other investment advices posted on this group as and when found during last 7 years, such as DCK 125 SQY trading on volumes in 2016, (yet another case study), DHA Peshawar to name few of the list. if, all the advisory notes of this group are put together then how much the final bank balance turns out to be, is left to your imagination.

Now Pay attention

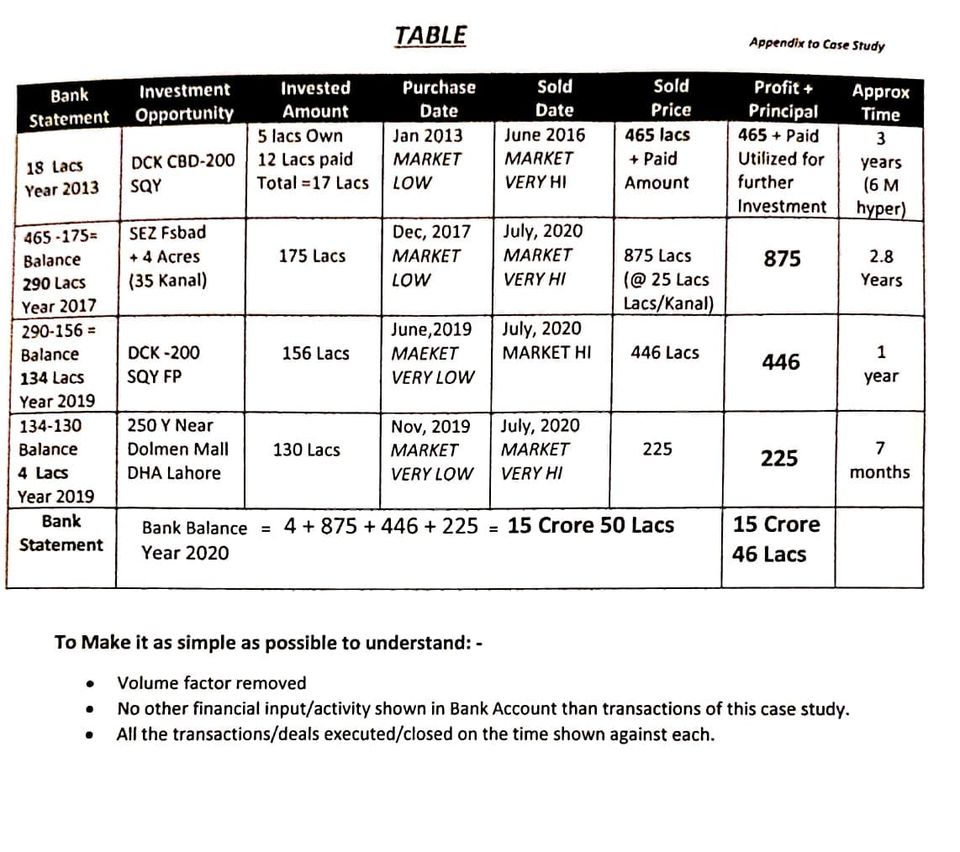

A “TABLE of Figures” is given below. To understand as to what the following paragraphs are referring to, first go through the table given below, come back here and resume reading further.

(1) Financial Capacity.

Just see in the table, the bank statement of Rs 18 Lacs turns into 15 Crore and 50 Lacs for someone, (herein after referred to as “Mr. SOMEONE”), who once in a life, had Rs. 18 Lcas as his total worth and had some earning capacity of paying Rs. 50,000/- installment after every 3 months, for good about 4 to 5 years. Here majority of members are quite capable of such financial capacity.

(2) Low- Cost Investment Opportunity.

The extremely low-cost opportunity as depicted first investment in given table shall again appear at sometime, somewhere, disguised in some other form of difficult decision. Opportunities just don’t stop keep coming in and going out. Only need to look at the things from investors’ perspective.

[Investor’s perspective = Emotionless perception + Prompt decision + Action]

(3) CAGR.

Generally speaking, more than 3 years of investment may not be a financially smart investment (except in extreme circumstances) Pay attention in the right most column of the table, where the periods of investments are within 3 years. If it is above 3 years it adversely affects CAGR (compound annual growth rate). If an investment did not work within 3 years or so, its means something was wrong with either “perception”, “judgement”, “information”, “timings” or combination of each at the time of choosing an option to invest. This point will get clearer as you go through this paper.

(4) Safe & Secure Investment.

Kindly note the legal status of all the examples tabulated below are free of land issue/litigation/illegal occupation (qabza)/ bad reputation and have an absolute clear title in the name of investor duly issued by competent authority.

(5) Naturally Occurring Opportunity.

Please note, investment activity in the table occurs on an average twice a year or so, essentially on the opportunities, coming along the natural flow of events. No pushing, running, thinking whole day long about money and investments. Just go along with your normal work/job/business and leisure’s of life. You must invest, the moment you come across an opportunity as and when observed, physically or virtually on social media.

(*PS. 4 examples came into the notice of this author along natural flow of events)

(6) Mind Pull.

While going through the table, make a note that whenever you have amounts like 4.65 crore in your bank account above your requirements, the mind automatically starts asking questions what to do with this ? or where to invest. Whenever so, don’t make hasty and herd mentality decisions just because the amount is available there and it must be invested at the earliest any randomly found or casually suggested option of investment. (do take information from the dealers but not the investment advice. this paper will help you to take own decisions). Be informed, there is a difference between “investment option” & “Investment opportunity”. Let an opportunity to be found first. Noticed the dates in table ? The date of first profit taking (June2016) and the date of second investment (Dec2017) based on the profit so taken in June2016. This is one of the best kept investors’ secrets, “invest in opportunity”.

(7) Keeping Abreast with Markets

The words Market Hi / Market low in the table express far & wide reach of social media with which one can know current prices/status/info of any market across the country at any given moment. Mr. SOMEONE gathered all the information, remained abreast etc with the market invested in with same kind of device you are looking at NOW.

(8) Environmental Effects.

Please recall that everything, the market fluctuations, opportunities, economic conditions, political government, development status, estate dealers, traffic, rain, and newly found constrain COVID-19, I mean everything was equally same for everyone. The only thing that differs in this table is, “THE INVESTOR’s MINDSET”. (Investors’ mindset = Emotionless perception + prompt decisions + Action)

(9) How to Asses the Investment will Work well.

There could be 100 of points to be considered to select an investment option. These 100 points includes only one objective point and rest 99 subjective point. These 99 points can be argued in either way and stand more convincing to all at physical level. Of the 100, only 3 points works for best possible decision of where and when to invest. Rest 97 are distractions and most often happens to be the reason for loss, level, marginal, routine and average profits or missed opportunity. These 3 points are as following which make an opportunity worth investing:

(i) Objective Point : PRICE . The low price, foremost criteria for an investor. Self-explanatory. A price being a number is objective in nature and has no subjectivity. Thus happens to be the only one point as objective of the 100 points of investment .

(ii) Subjective Point :BIG PLUS = Any good reason(s) of investment is called as “BIG PLUS’ that has to be coupled with LOW PRICE. For instance, DCK is a reputed brand across the country. If 125 SQY Commercial plot in DHA Karachi Phase-8 is worth +700 Lacs in 2013, then why can’t DCK Commercial 200 SQY can reach say half of its price around 350 Lacs. This is a BIG PLUS. On the other side, the 97 distraction points of DCK are, too far, too away, too barren, too hopeless, too slow development, too lazy management, too much hustle [going Lhr to Kar], too uncertain, too unpredictable, too shrewd property people, too much cuts/topping of the dealers, too bad economy, too corrupt government, too worse law & order, too dangerous city (kar in2013), too bad political situation, too bleak future….too…too… I can literally go up to rest of the 97 distractions with ending sentence of, how one can invest in DCK(in2013) in right state of mind in worse situations all around. Similarly how can one in right state of mind can pay 1 Coror 75 Lacs (in2017) for 4 acres of uncultivatable barren land with nothingness, no human existence, wilderness all around, undrinkable water underneath and situated on a road suitable (in2017) for tractors only. On the other side one BIG PLUS was very big. This piece of land happened to be in front of the future main gate of (SEZ) Special Economic Zone Infrastructure (only offset by 200meters). Similar was the case in last invest in the table before commencement of Dolmen Mall construction in Lahore. Mr. SOMEONE, however, did not concentrate on the distractions much but focused more on 3 points + “important factors of investment” presented in this paper. Trusting faith in Almighty, Mr. SOMEONE invested his hard-earned lifelong savings in DCK first and subsequently as shown in the table. Go through the table and see the exact happening the same with every event of investment.

(iii) Subjective Point :LUCK One of the 100 points of investment is luck. Give weightage 1% to luck. As the saying goes, “Luck favors the brave”. If you will not take calculated risk ever in your life, how luck can work for you ? Balloting in housing scheme is one such example of luck at work.

What Property Investment is all About .

Investment is all about (1) patience (when markets are down), (2) Psychology (when markets are up/hyper indecisiveness sell, not sell, hold, greed, fear of again market going down) (3) Moral Values (Self-explanatory, + abiding by best market practices.). Prefer profit taking decision a combination of two factors, time + Price (3 year & Price, whichever is earlier) in stead of single consideration of price only.

(11) Volume Factor

Volume factor depends upon the individual’ financial capacity. Look at the bank statement year 2013 of Mr. SOMEONE. He could only afford to purchase one file that is called volume factor 1. Had you been in his place, you could have purchased 2 or 3 Files or or whatever the financial capacity was. If Mr. SOMEONE could have purchased 3 files, he would have invested further with Volume Factor 3 with rest of the 3 subsequent investments accordingly in the given table. Now multiply 15 Core 46 Lacs (total profit + principal at the end of day) with 2 or 3 and do your math. This is the difference between full-time investors and salaried persons on job and small business man. Full time investors play with volume factor. Whereas, on job person thinks investment in terms of volume factor 1 or 2 with little to no consideration or awareness to the important factors of investment explained as above and thus hardly ever reaches to a point of financial independence, a point where money works for you and you don’t work for money.

(12) Personal Example

Again here, I will have to give a personal example as usual like advising for investment on this page. I carry out buy/sell first and then put advise on the Group. This is the reason my advices do not come with any disclaimers of “at your own risk & decision”. My practical real estate business experience is as old as this group is, 7 years. However, during service, my occasional reading topic on week ends was real estate. The books of world-renowned real estate investors. I knew well, back then in service also as to how Real Estate Markets work. What are the market dynamics and practices of DHA, BAHRIA TOWN, CDA etc. I was fully equipped with real knowledge of real estate but did not do any business except kept gaining knowledge since PAF does not allow its personnel to indulge in any kind of business. I put this theoretical knowledge into practical the next day I was out of service. It did wonders. You can do it too.

(13) Expression of Gratitude.

Last but not the least. Be grateful to Almighty for what all you have at this moment. To express this gratitude, help deserving people around you, financially and otherwise.

(14) The Challenge At the end, it’s not money. It’s the financial challenge that money poses to every one of us, every now & then and more especially when needed in large sums. Meet this challenge in befitting manner with best possible version of your good self and live the life at your own terms.

Wishing you all the best in your future endeavors.

Have a Nice day….!